SalaaMedia: January 10, 2025

Upon its decision made in November, last year, the Government of Sudan has finally replaced one bill of the Sudanese currency (only the one-thousand-pound banknote), while the initial intention was to replace tow notes. The replacement process, which ended on January 6, 2025, covered seven states out of the country’s 18 states. The Sudan Central Bank acknowledged that the currency replacement in 11 states has been postponed due to exceptional measures, hence ensuring accurate implementation of the plan to preserve citizens’ rights. The Bank stressed that some bills of the old currency are exempted until they are replaced later. Despite the challenges, the Central Bank stressed its commitment to fairness and inclusivity of the process. However, Darfur states were among the states that were excluded from the process, based on RSF’s rejection of the new currency notes, considering them as illegal tenders. RSF proceeded to issue a decision preventing circulation of the new currency bills in the region, while allowing the circulation of foreign currencies.

In this report, SalaaMedia Center records the effects of the currency replacement as well as banning its circulation within RSF-controlled areas.

Rights Basis

The process to replace the currency in some SAF-controlled states disregarded the rights of citizens within RSF-controlled states. According to Article 22 of the Universal Declaration of Human Rights, “Everyone, as a member of society, has the right to social security and is entitled to realization, through national effort and international cooperation and in accordance with the organization and resources of each State, of the economic, social and cultural rights indispensable for his dignity and the free development of his personality”.

In addition to the provisions of the International Covenant on Economic and Social Rights, States Parties undertake to take the necessary measures to realize the right of everyone to an adequate standard of living for himself and his family.

“The decision to replace the currency is likely a political decision rather than being legal, as it is inconsistent with the international laws, the World Bank regulations and the policy of the Central Bank of Sudan”,

a Sudanese legal expert, Ezzeldine Al-Marboua stated. He stressed that the decision is unfair as it violates the rights of people in one country who should enjoy all their rights and duties as stipulated by international laws. Al-Marboua pointed out that the Universal Declaration of Human Rights and Article 11 of International Covenant on Civil and Economic Rights advocates for citizens’ right to a life and preserves their dignity, that includes the state’s obligation to provide a decent life and standard for individuals. He further said:

“Currency replacement is a right that all Sudanese citizens should enjoy without discrimination, including those living within RSF-controlled areas. Currency replacement is an economical right associated with the rights of citizens living in state“.

Commenting on the regulation issued by the Legal Department of the Supreme Council of Civilian Administration Units in RSF-controlled areas, which criminalized the circulation of new currency in the region, amounting to imprisonment, a fine, or both penalties, Al-Marboua said that; denying certain communities to circulate the new currency, is a clear violation of their rights and international laws.

“I believe the currency replacement is a right that citizens in Darfur region should enjoy as long as it affects their daily life and economic situation,” he added.

Omar Ismail, a banking expert, believes that the current circumstances are not favorable for currency replacement being it political, economic, security or even the geographical unity of the country. He seconded Al- Marboua believing that the currency replacement is most likely to be politically motivated rather than economical, because the process does not meet the economical and financial conditions of the monetary reform processes under which currencies are replaced. Such conditions include control of excessive inflation rates, continuous declining of currency value, as well as decreasing purchase power within the framework that requires comprehensive monetary reforms.

Impact of Currency Replacement

In the event of the currency changing decision on November 9, 2024, crop and livestock markets in Darfur experienced stagnation, while some markets faced shortages of food items due to prices increase. Upon initiating the replacement process on December 10, 2024, the situation in Darfur noticeably improved. A number of citizens and traders in East, South and West Darfur spoke to SalaaMedia about the impact of currency replacement on the markets in the region. Hassan Al-Siwar a trader from Nyala said that; the currency replacement that took place in some states of Sudan did not impact negatively in Darfur, adding that; since the war broke-out, they stopped dealing in cash, instead they resorted to trade through banking applications to buy goods from Al-Dabba in the Northern State and Chad. Al-Siwar said that the replacement measures did not affect the prices of goods in the region’s markets.

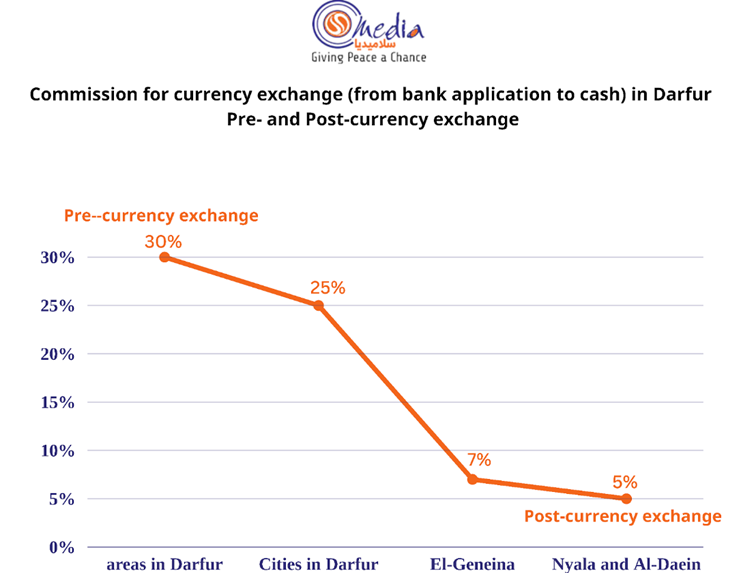

Mohammed Saleh Al-Bishr, a journalist based in Al-Daein town, explained that the currency replacement had a positive impact on the situation in Darfur, as commissions to trade cash vis a-vis bank deposits applications, decreased from 25% to 5% in Nyala and Al-Daein, and 7% in El-Geneina. He pointed out that after the replacement procedures, the mass of cash in the region became very sufficient, adding,

“The step multiplied cash availability in Darfur.”

In an interview with SalaaMedia, a financial policy expert (who requested anonymity) attributed the declining commissions of trading cash with banking applications, to citizens’ fears and lack of confidence on the monetary policy governing the transactions. The expert did not rule out that trading commissions may reverse, to the extent that cash holders pay a commission in exchange for depositing money through bank applications. He pointed out that the positive effects of the currency replacement in Darfur, may gradually turn negative due to the increments in the monetary volume, which may lead to inflation and heightens goods’ prices. He warned about possibilities that the old currencies are supplied to Darfur from the states where it has been replaced already. Over time, banknotes would erode, such could lead to smuggling the banned new currency into Darfur. The financial expert further explained the danger of this move as it would expose citizens to abuses by the authorities controlling the region. Noting that the authorities in Port Sudan may move to ban some bank accounts and confiscate its credits on geographic or ethnic grounds.

“Currency replacement is a right that all Sudanese citizens should enjoy without discrimination, including those living within RSF-controlled areas.”

Ezzedine Al-Marboua, Legal Expert

Impact on Exchange Rate

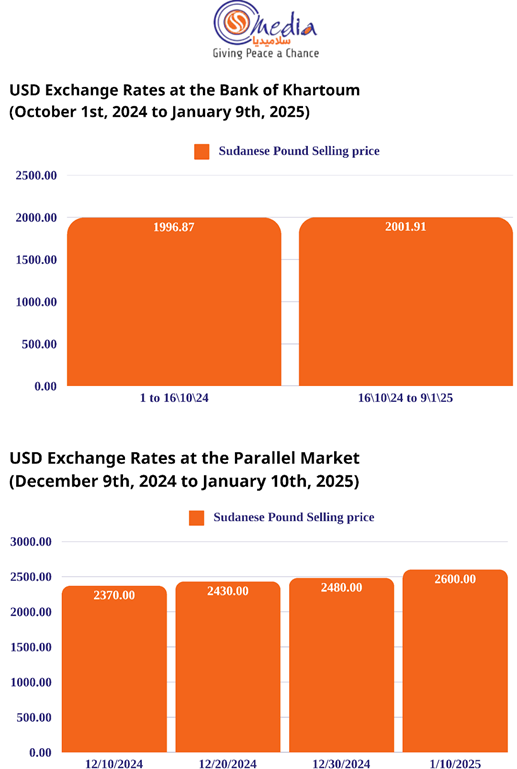

Through monitoring the exchange rates of the Sudanese Pound against the US Dollar, there is a clear discrepancy between bank rates and the parallel market. As regards bank rates, prices remained stable since mid-October, while prices in the parallel market continued to escalate during December 2024 to early January 2025.

Impact on Humanitarian Aid

The currency replacement process did not affect the distributed cash aid by some organizations in the region. Abdul Rahim Adam Mohammed, an IDP in Otash camp in South Darfur, stated that during the last week of December, IDPs received cash aid in the old bills. Observers suggested that the flow of financial aid in the region will not be affected by the currency replacement, as humanitarian organizations are starting their operations from Adré town along the Chad borders with Darfur, and therefore, they do not need cash in the new bills.

Cash Alternatives

Prior to the currency replacement, citizens depended on bank applications and circulation of foreign currencies in order to overcome the cash shortage crisis. In light of the recent developments, some Darfur states introduced foreign currencies to counter the expected negative effects of the currency replacement. However, Muhyiddin Zakaria, a journalist based in Al-Geneina, told SalaaMedia that; he did not notice any negative effects of the currency replacement on the markets in West Darfur. He noted that for commercial use, citizens rely on foreign currencies, especially the Chadian franc, which was confirmed by other sources in other states. The financial policy expert believes that circulating foreign currencies in parts of the country may expose the national currency to further devaluation, while it would increase producers’ income and competitiveness in the region.

Reactions

Reactions varied between rejection and support, though SalaaMedia did not observe any reactions from citizens within the region, other than reacting to the Supreme Council of Civilian Administration Units rejection of the new currency. In addition, RSF has proceeded to pay its soldiers in US Dollars.

The National currency replacement is an additional violation on the chain of violations committed by the warring parties in Sudan, depriving large segments of Sudanese population of their economic rights. Darfur citizens are caught between the exclusion of the government in Port Sudan from the replacement process and RSF’s decisions criminalizing the circulation of the new notes in the region. Despite these violations, the reality in the region reflects the positive effects of the replacement process, through the stability of market prices and abundance of cash, which in turn led to decrease the commissions of bank applications vis a-vis cash. On the contrary, the currency replacement process caused a cash shortage and high commission percentage (30%) in trading cash for bank application deposits in the states where the process took place. Therefore, the warring parties must commit to a fair financial policy that guarantees Sudanese economic rights and decent life.