Report: SalaaMedia

The decision of the Central Bank of Sudan to change some denominations of the Sudanese currency sparked widespread reactions. This is because of its economic and political effects related to the war the country is witnessing. Although the Central Bank formulated a number of justifications for printing the new currency, including draining the markets of counterfeit currencies looted from banks, banks, companies, shops and homes. However, the decision may cause additional living suffering for civilians in conflict areas, especially the Darfur region, due to the Central Bank’s loss of the mechanism for distributing cash currencies throughout the country and its inability to send new denominations to those areas, where banks and banks have gone out of service. The battles that took place between the armed forces and the Rapid Support Forces in the main cities of the Darfur region led to the destruction of most of the bank branches after their balances were looted, and thus they were completely out of service. Which led to a scarcity of cash among civilians to the point of nonexistence due to the complete interruption of the periodic supply of banknotes to the cities of the region.

In this report, the Salaamedia team monitors the effects of the war on the banking sector, the availability of cash in Darfur, financial transactions between the region’s citizens through banking applications and other ways of exchanging goods and benefits. In addition to the expected effects of the decision to change some currency denominations, it also monitors the reactions provoked by the decision.

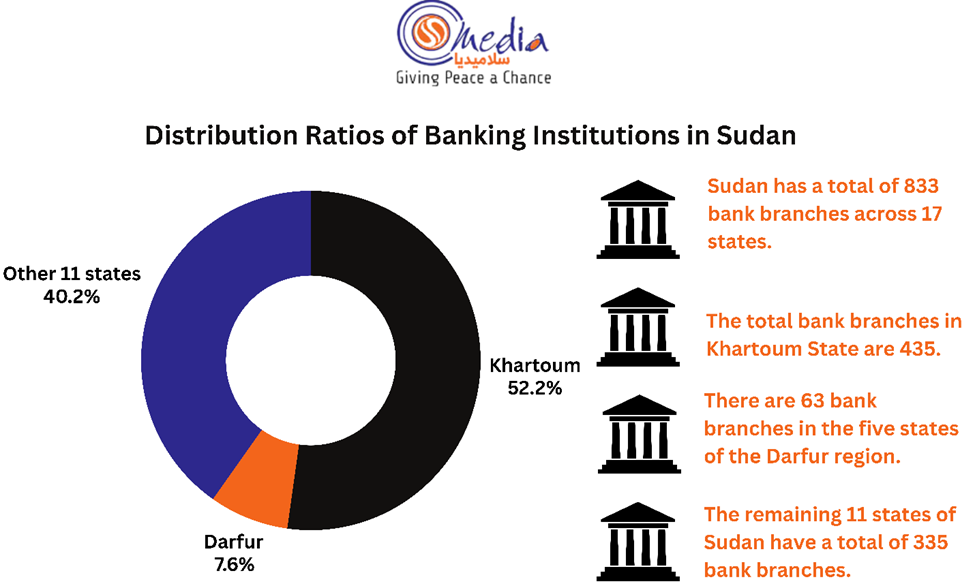

Banking sector

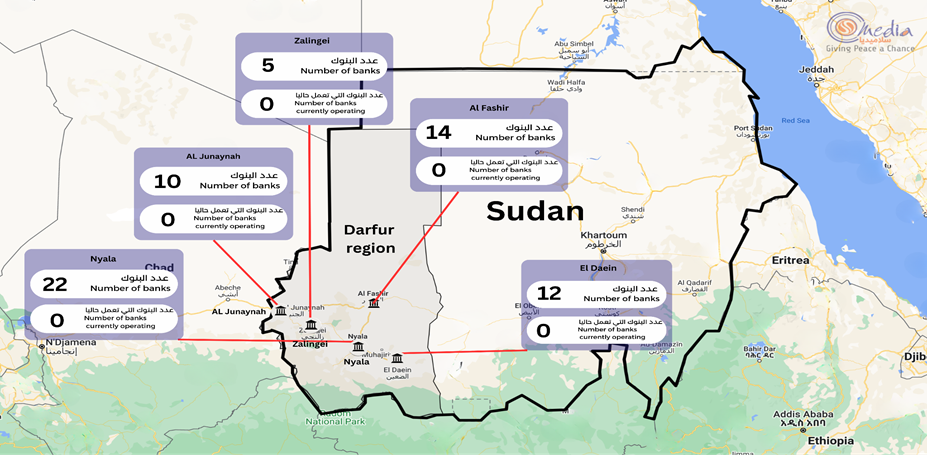

Most Sudanese banks have branches in the cities of the five states of Darfur. According to sources who spoke to Salaamedia, the number of banking and bank branches exceeds 63; With 22 branches in the city of Nyala, 14 in El Fasher, 10 in El Geneina, 12 in El Daein and 5 branches in Zalingei. In addition to the branches of the Agricultural Bank in the localities in the five states, which we were not able to enumerate. What is worth mentioning is that all of these banks were affected by the war and went completely out of service.

Alternatives after the war as a result of the devastation that affected the banking sector in Darfur, civilians increased their reliance on banking applications that allowed them to receive and send transfers and financial transactions. This mass reliance on banking applications faced an obstacle represented by the continuous decrease in cash liquidity, due to the lack of official mechanisms for replacing or withdrawing currencies and pumping cash denominations from outside the region; which prompted account holders on banking applications working in the field of financial transfers and their delivery to deduct rates that reached 30% of the transferred amounts in exchange for paying them to their recipients in most parts of the region, taking advantage of the scarcity of cash. Thus, the suffering of citizens who depend on remittances has doubled. On the other hand, the civil administrations formed by the Rapid Support Forces in the states of Central and South Darfur, as well as the civil administration in the areas controlled by the Sudan Liberation Movement – led by Abdel Wahid Nour, issued decisions according to which the discount rate was reduced to 7% in South Darfur, 10% in Central Darfur, and 10%. In areas controlled by the Sudan Liberation Movement; However, these decisions were not adhered to, according to SalaaMedia’s observations. The crisis of cash scarcity has forced the residents of some cities and regions in the region to follow the barter system (commodity exchange). While the markets in the city of El Geneina in Western Darfur adopted foreign currencies such as the US dollar and the African franc for commercial trading and to confront the scarcity of cash liquidity.

Effects of changing the currency

Some effects began to appear on the back of the decision taken by the Central Bank of Sudan to change some denominations of the Sudanese currency, as merchants in Darfur’s border areas with neighboring countries reported that southern and Chadian merchants had stopped dealing in the Sudanese pound since they heard of the decision of the Central Bank of Sudan and stipulated to deal in the new denominations. While Chadian merchants allowed purchases to be made through available banking applications or payment via the franc currency.

Feedback

There were a number of reactions to the decision, most notably from the Rapid Support Forces, which claimed that the decision served as a prelude to dividing the country. Quoting (Sky News), the Rapid Support Forces indicated the illegality of the decision to exchange currencies, as Sudan is suffering from a comprehensive collapse, and a dysfunctional and dysfunctional banking system in most states. “It is not based on a legal justification and is invalidated by financial protection systems for individuals in light of disasters and wars, and remains purely “Economic recklessness to achieve known political goals.”

In the same context, the financial analyst, Ahmed Bin Omar, agrees with the claim of the Rapid Support Forces, that the decision may be devoted to an administrative separation that in turn would lead to the formation of two governments with two different financial systems. Dr. Hafez Al-Zein, a professor of economics at a number of universities, went on to describe the currency exchange as an exercise in monetary secession, followed by political and then regional secession.

However, the banking expert and former official at the Bank of Sudan, Mohamed Esmat, denied the possibility of devoting the decision to dividing the country on the basis of the controlling party (the Armed Forces and the Rapid Support); Pointing out that the decision aims to “kill” the criticism among the public in the areas controlled by the Rapid Support

Economic analyst Adam Ahmed believes that the decision will have a major impact on civilians in areas controlled by the Rapid Support Forces. He said that the solution lies in implementing the decision with flexibility that allows the old currency to be circulated alongside the new currency for a period of at least six months. Economic analyst Wael Fahmy says that the short period allowed for circulation of the old currency will affect civilians who hold the old denominations, due to the possibility of a lack of access to banks.

The repercussions of the process of changing the currency are not limited only to economic and monetary problems, but rather extend to internal political and regional security repercussions whose final outcome is likely to bear more than the perception of two separate states or two political systems in one divided state. Changing the currency is not an ordinary routine procedure, but it has fatal economic, political and social consequences if it occurs outside of internationally accepted conditions. We at SalaaMedia draw attention to the seriousness of this measure and the costly value of its economic and political bill.